All about Redbud Advisors, Llc

Table of ContentsRedbud Advisors, Llc - The FactsRedbud Advisors, Llc Fundamentals ExplainedAll About Redbud Advisors, LlcThe Basic Principles Of Redbud Advisors, Llc Not known Details About Redbud Advisors, Llc

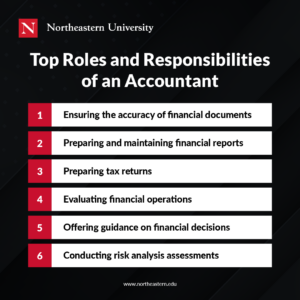

Accounting professionals can find work with an accountancy firm or a big firm with an interior accounting division, or they can set up a private technique. Many accountants select to end up being Licensed Public Accountants due to the fact that the certified public accountant designation is taken into consideration the gold criterion in the accounting profession. Accounting professionals are economic experts that take cost of a series of accountseither personal or public.Although your accountant may have greater than one classification, the most usual are Qualified Inner Auditor, Qualified Monitoring Accountant, and Cpa. Lots of accountants pick to come to be Certified public accountants because the designation is taken into consideration the gold requirement in the accountancy occupation. In the USA, accreditation needs for accounting professionals can vary from state to state.

This was greatly because of the fact that businesses grew in complexity and the investors and shareholders, who were not necessarily a component of the company but were monetarily invested, wanted to understand even more concerning the economic well-being of the companies they were purchased. After the Great Anxiety and the development of the Securities and Exchange Compensation (SEC), all publicly traded firms were needed to release reports composed by approved accountants.

The smart Trick of Redbud Advisors, Llc That Nobody is Discussing

Administration is liable for the financial info produced by the company. https://www.cheaperseeker.com/u/redbudadv1sor. Professional accounting professionals in businesses as a result have the job of defending the high quality of monetary reporting right at the resource where the numbers and figures are created! Like their counterparts in tax or bookkeeping, professional accounting professionals in company play essential functions that add to the total stability and progress of society

This is an important possession to monitoring, especially in little and average ventures where the expert accountants are often the only skillfully certified members of team. Accountancy professionals in company assist with corporate method, give guidance and assistance companies to lower expenses, improve their leading line and minimize risks. As board directors, professional accounting professionals in business stand for the interest of the proprietors of the company (i.

Not known Factual Statements About Redbud Advisors, Llc

As a profession that has actually been bestowed a privileged setting in culture, the book-keeping profession in its entirety handle a vast array of problems that has a public passion angle. In the instance of professional accountants in service, not just need to they maintain high standards however they likewise have a crucial duty to play in helping organizations to act ethically.

Accountants will certainly shed their authenticity as guards of public passion if there is no public depend on. The book-keeping career has vast reach in culture and in worldwide capital markets. In the many fundamental method, confidence in the financial information generated by professionals visit this website in businesses creates the core of public trust and public value.

Balancing these completing demands talks with the very heart of being a professional unlike simply working or performing a function. Professionals are expected to work out specialist judgment in executing their functions to ensure that when times get tough, they do not carry out actions that will result in the profession shedding the general public's depend on as guards of public rate of interest.

About Redbud Advisors, Llc

At the nationwide level, the specialist accounting body is the voice for the country's specialist accountants; this consists of all expert accounting professionals both in practice and in business. Since they play various duties in the culture, the total condition of the accountancy occupation can just be enhanced when both expert accountants in method and in service are well-perceived by society.

Like other occupations, professional accountants are significantly tested to show their relevance in the funding market and their capacity to advance and deal with new challenges. https://www.pageorama.com/?p=redbudadv1sor. Public expectations are high. GAAP Bookkeeping OKC. The value of expert accounting professionals will certainly be measured by the extent to which they are viewed to be responsible not only to their own organizations but even more importantly to the public

An Unbiased View of Redbud Advisors, Llc

Public education and learning on the varied functions of professional accounting professionals in organization requires to be stepped up so as to raise the visibility of these duties. Expert bookkeeping bodies also require to take notice of their participants in company and provide them with the assistance they require in order to be successful in their duties.

Those concerned about their P&L statement usually have a flat team framework that focuses on hiring individuals to do the work on hand. In a firm such as this: Absolutely nothing runs efficiently on its own Working with the best team is difficult Team retention is reduced, The proprietor functions long hours playing consistent catchup, Little idea is put into employing, the focus is on connecting holes What's a much better alternative?

It entails managing web traffic circulation or straightening communication with production which are two very various but essential roles for the firm. Effective companies understand you can not simply work with somebody and expect them to do all of the above. You need to understand the three most crucial roles in a company: Finders are usually your elderly customer managers and assistant client managers.